Finally, the limit applies on a per employer basis so long as the two employers are unrelated (i.e., not part of a controlled group or affiliated service group due to common ownership or shared services).

The limit applies per employee, rather than on a household basis, so if both spouses are employed and eligible for health FSA coverage, each spouse could contribute up to $2,8. In addition, employees who join mid-plan year may still elect up to $2,850 for the remainder of the plan year. Employer flex credits that the employee has the option to use toward cash or other taxable benefits.Įmployees may elect up to $2,850 even if they’ve carried over up to $550 from the previous plan year.Amounts deducted pre-tax from an employee’s compensation through a cafeteria plan and.Employee Health FSA ContributionsĮmployee contributions subject to the $2,850 annual limit include: Employer contributions are not subject to the limit but are subject to different restrictions under healthcare reform rules. The annual contribution limit of $2,850 for health FSAs applies specifically to employee contributions: The same limit applies for general-purpose and limited-purpose health FSAs.

/thinkstockphotos81178154-5bfc3bb246e0fb0083c4a2d1.jpg)

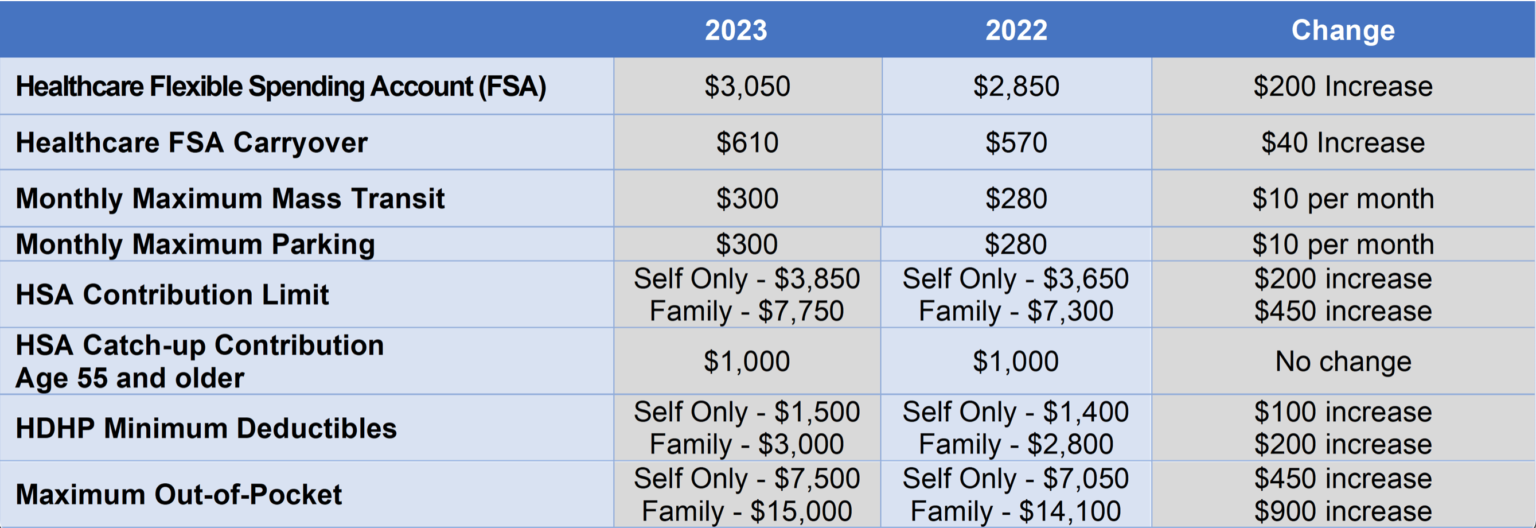

The limit on monthly contributions toward qualified transportation and parking benefits for 2022 is increased to $280, up from $270 in 2021. The limit on annual employee contributions toward health FSAs for 2022 is $2,850, up from $2,750 in 2021 with the ability to carry over up to $570, up from $550 in 2021. Among other things, the notice indicates that employee contribution limits toward health flexible spending arrangements also known as flexible spending accounts, or FSAs, and qualified transportation fringe benefits will increase slightly for 2022. In Revenue Procedure 2021-45, the IRS sets forth a variety of 2022 adjusted tax limits.

0 kommentar(er)

0 kommentar(er)